Page 23 - Turkinsurance Digital Magazine

P. 23

23

The insurance sector’s technical

profit reached 81.9 billion TL in the first

half of 2025

According to the consolidated balance sheet and income statements for the end of

June 2025 announced by the Insurance Association of Türkiye (TSB), the total tech-

nical profit in the non-life branch reached 66,746,451,000 TL, while the life branch

reached 14,430,784,000 TL, and the pension branch reached 810,813,000 TL.

The sector’s total profitability was recorded as 81,988,049,000 TL.

Technical losses reached 28.2 billion TL across 163.6 billion TL in claims paid in the first half

10 branches

In the first half of 2021, the sector paid 13.857 billion TL

In the first half of 2024, total losses of 17.1 billion TL were in net claims in the non-life branch and 2.075 billion TL in

recorded across 5 branches. In the first six months of 2025, the life branch. This figure rose to 127.115 billion TL in the

however, total technical losses reached 28.2 billion TL across first half of 2022. In the first half of 2023, claims paid to-

10 branches. taled 48.019 billion TL. In the first half of 2024, claims paid

amounted to 101.4 billion TL, and in the first half of this year,

In the first half, the motor third-party liability (traffic) branch the figure reached 163.6 billion TL.

recorded a loss of 23.9 billion TL with a profit/loss ratio of

-31.2%. State-supported agricultural insurance posted a loss Premiums written, which had a significant impact on technical

of 363 million TL with a profit/loss ratio of -8.6%. The sure- income in the first half of 2025, reached 360.8 billion TL in

ty branch (kefalet) recorded a loss of 105.7 million TL with the non-life branch and 75.1 billion TL in the life branch.

a profit/loss ratio of -38.5%. The credit branch recorded a

loss of 109.2 million TL with a profit/loss ratio of -39.7%. Looking at claims paid by branch: 304.7 million TL in the ac-

The motor liability branch (kara araçları sorumluluk) posted cident branch, 52.1 billion TL in the sickness–health branch,

a loss of 2.9 billion TL with a profit/loss ratio of -3%. 33.4 billion TL in the motor vehicles branch, 83.4 million TL

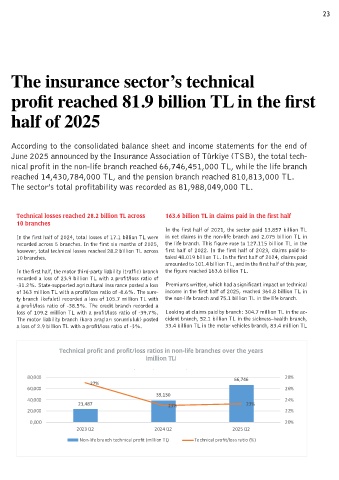

Technical profit and profit/loss ratios in non-life branches over the years

Technical profit and profit/loss ratios in non-life branches over the

(million TL)

years (million TL)

80,000 66,746 28%

27%

60,000 26%

39,130

40,000 24%

23,487 23% 23%

20,000 22%

0,000 20%

2023 Q2 2024 Q2 2025 Q2

Non-life branch technical profit (million TL) Technical profit/loss ratio (%)