Page 31 - Turkinsurance Digital Magazine

P. 31

31

Yıllar itibarıyla trafik ve kasko branşlarında teknik kar ve zarar tutarları (milyon

Technical profit and loss amounts in traffic and motor

TL)

insurance branches by years (million TL)

2.000 1.600 1.157

1.000 864 792 502 15,334 14,891

0 -801 -407

(1.000) 2019 2.Ç 2020 2.Ç 2021 2.Ç 2022 2.Ç 2023 2.Ç 2024 2.Ç

(2.000) -5,722 -10,118

(3.000)

(4.000)

(5.000)

(6.000)

(7.000) -5.843

TRAFİK KASKO

69.6 million TL, in the watercraft branch, 835.4 million TL, in lion 891 million TL.

the transportation branch, 552.5 million TL, and in the fire and

natural disasters branch, 4.1 billion TL in claims were paid. In Premiums written off in the motor insurance branch were seen

the general damages branch, 2.4 billion TL in claims were paid, as TL 47 billion and damages paid were seen as TL 23.6 billion.

while in the land vehicles liability branch, 38.9 billion TL, in the

watercraft liability branch, 60.7 million TL, in the general liabil-

ity branch, 594 million TL, in the credit branch, 59.9 million TL, Claims paid in life branch by years

in the guarantee branch, 15.7 million TL, in the financial losses

branch, 227.9 million TL, and in the legal protection branch, 1.8 (million TL)

million TL in claims were paid.

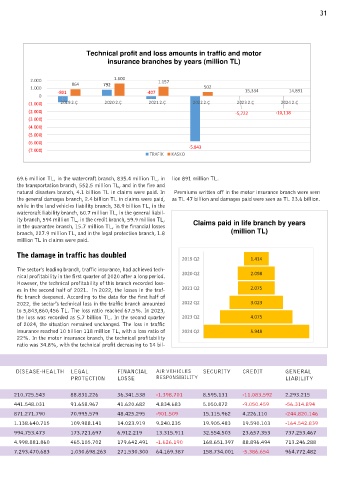

The damage in traffic has doubled

2019 Q2 1.414

The sector's leading branch, traffic insurance, had achieved tech- 2020 Q2 2.098

nical profitability in the first quarter of 2020 after a long period.

However, the technical profitability of this branch recorded loss-

es in the second half of 2021. In 2022, the losses in the traf- 2021 Q2 2.075

fic branch deepened. According to the data for the first half of

2022, the sector's technical loss in the traffic branch amounted 2022 Q2 3.023

to 5,843,860,456 TL. The loss ratio reached 67.5%. In 2023,

the loss was recorded as 5.7 billion TL. In the second quarter 2023 Q2 4.075

of 2024, the situation remained unchanged. The loss in traffic

insurance reached 10 billion 118 million TL, with a loss ratio of 2024 Q2 5.948

22%. In the motor insurance branch, the technical profitability

ratio was 34.8%, with the technical profit decreasing to 14 bil-

Technical profit and loss amounts arising in selected branches as of the periods (TL)

ACCIDENT LAND VEHICLES GENERAL LAND VEHICLES TRANSPORTATION FIRE AND DISEASE-HEALTH LEGAL FINANCIAL AIR VEHICLES SECURITY CREDIT GENERAL

DAMAGES RESPONSIBILITY NATURAL PROTECTION LOSSE RESPONSIBILITY LIABILITY

DISASTERS

2018 Q2 442.820.755 230.124.184 168.514.821 66.091.981 143.669.038 361.249.700 210.725.543 88.831.226 36.341.538 -1.398.701 8.595.131 -11.083.592 2.293.215

2019 Q2 575.855.817 864.309.614 338.737.002 -739.206.279 182.228.335 354.610.541 441.548.031 91.658.967 41.620.682 4.834.683 5.050.872 -9.050.459 -56.314.894

2020 Q2 645.250.473 1.600.568.823 276.508.525 882.668.028 156.682.376 441.849.687 871.271.790 70.995.579 48.425.295 -901.509 15.115.962 4.226.110 -244.820.146

2021 Q2 657.571.643 1.157.763.141 572.172.114 -290.970.678 239.695.484 669.601.621 1.138.640.715 109.988.141 14.023.919 9.240.235 19.905.483 19.590.103 -164.542.839

2022 Q2 917.374.256 502.965.055 639.985.480 -5.461.350.727 504.015.003 942.809.905 994.753.473 173.721.697 6.912.219 13.315.911 32.554.503 23.657.353 737.253.467

2023 Q2 2.123.258.060 15.334.916.315 2.246.792.955 -4.903.620.604 626.902.554 1.009.709.311 4.998.881.860 465.105.702 179.642.491 -1.626.190 168.651.397 88.896.494 713.246.288

2024 Q2 4.760.760.543 14.891.473.840 4.826.599.209 -7.009.094.168 1.552.424.011 8.792.250.673 7.293.470.683 1.030.698.263 271.530.300 64.169.387 158.734.001 -5.386.654 964.772.482