Page 25 - Turkinsurance Digital Magazine

P. 25

25

The fund size of participants in the private pension system increased by

44.9 percent at the end of the first half of 2021 compared to the first

half of 2020, from 118.7 billion TL to 171.7 billion TL. In the first half

of the year, the funds that earned the most proportionally were debt in-

struments, precious metals, basket of funds, money market, participation

funds, mixed&flexible funds and stocks, respectively.

Maximum rate of return in debt instruments funds

When the first half performance of private pension funds, which aim to

provide profit to their investors in the long term, is analyzed, debt in-

struments yielded 9.36 percent, precious metals 9.06 percent, fund bas-

ket funds 8.65 percent, money market funds 8.39 percent, participation

funds 5.81 percent. , mixed&flexible funds 1.72 percent and stock funds

1.60 percent.

In the same period of the previous year, the rate of return of debt instru-

ments funds with the highest rate of return was seen as 10.24 percent.

When we examine the monthly occupancy rates of debt instruments funds,

we see that the occupancy rate reached 3 percent in January, 2.99 per-

cent in February, 1 percent in March, 2.99 percent in April, 3 percent in

May and 3.06 percent in June.

Precious metals funds yield 9.06 per cent

Participation funds, which provided 34.51 percent returns to their partic-

ipants in the first half of 2020, were the second group of funds to provide

the largest percentage of returns to their participants in the first half of

2021. Monthly occupancy rates for participation funds, which provide

returns of 9.06 percent, reached 7.84 percent in January, 7.79 percent

in February, 7.86 percent in March, 8.01 percent in April, 8.08 percent

in May and 8.11 percent in June.

Basket of funds had the 3rd highest rate of return

The third group of funds that generated the most returns in the first half

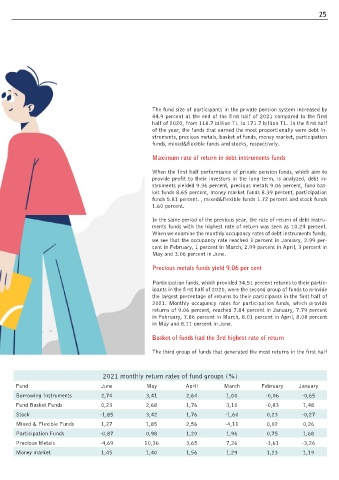

2021 monthly return rates of fund groups (%)

Fund June May April March February January

Borrowing Instruments 2,74 3,41 2,64 1,00 -0,06 -0,65

Fund Basket Funds 0,23 2,68 1,76 3,10 -0,83 1,48

Stock -1,85 3,42 1,76 -1,60 0,23 -0,27

Mixed & Flexible Funds 1,27 1,85 2,56 -4,11 0,02 0,26

Participation Funds -0,87 0,98 1,20 1,96 0,75 1,68

Precious Metals -4,69 10,36 3,65 7,26 -3,61 -3,26

Money market 1,45 1,40 1,56 1,29 1,23 1,19