Page 29 - Turkinsurance Digital Magazine

P. 29

27

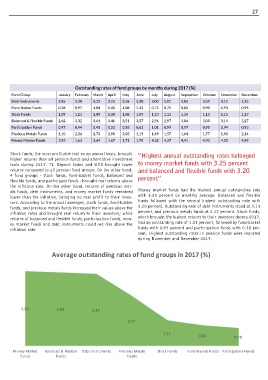

Outstanding rates of fund groups by months during 2017 (%)

Fund Group January February March April May June July August September October November December

Debt Instruments 2,85 3,20 3,22 3,25 3,28 3,30 3,00 3,02 3,06 3,09 3,11 3,15

Fund-Basket Funds 0,28 0,97 1,04 1,05 1,08 1,13 0,75 0,75 0,84 0,90 0,93 0,95

Stock Funds 1,09 1,11 1,09 1,08 1,08 1,09 1,10 1,13 1,14 1,13 1,15 1,17

Balanced & Flexible Funds 2,62 3,32 3,41 3,46 3,51 3,57 2,96 2,97 3,06 3,08 3,14 3,27

Participation Funds 0,97 0,44 0,45 0,53 0,58 0,63 1,01 0,99 0,97 0,95 0,94 0,93

Precious Metals Funds 1,10 2,56 2,73 2,90 3,05 3,19 1,49 1,57 1,64 1,77 1,90 2,14

Money Market Funds 3,93 1,63 1,64 1,67 1,71 1,75 4,32 4,37 4,41 4,43 4,50 4,59

Stock funds, the most profitable tool on an annual basis, brought “Highest annual outstanding rates belonged

higher returns than all pension funds and alternative investment

tools during 2017. TL Deposit Index and USD brought lower to money market funds with 3.25 percent

returns compared to all pension fund groups. On the other hand, and balanced and flexible funds with 3.20

4 fund groups - stock funds, fund-basket funds, balanced and

flexible funds, and participant funds - brought real returns above percent”

the inflation rate. On the other hand, returns of precious met-

als funds, debt instruments, and money market funds remained Money market funds had the highest annual outstanding rate

lower than the inflation, bringing no real profit to their inves- with 3.25 percent on monthly average. Balanced and flexible

tors. According to the annual averages, stock funds, fund-basket funds followed with the second highest outstanding rate with

funds, and precious metals funds increased their values above the 3.20 percent. Outstanding rate of debt instruments stood at 3.13

inflation rates and brought real return to their investors; while percent, and precious metals funds at 2.17 percent. Stock funds,

returns of balanced and flexible funds, participation funds, mon- which brought the highest returns to their investors during 2017,

ey market funds and debt instruments could not rise above the had an outstanding rate of 1.11 percent, followed by fund-basket

inflation rate. funds with 0.89 percent and participation funds with 0.78 per-

cent. Highest outstanding rates in pension funds were reported

during November and December 2017.

Average outstanding rates of fund groups in 2017 (%) *

3,25 3,20 3,13

2,17

1,11

0,89 0,78

Money Market Balanced & Flexible Debt Instruments Precious Metals Stock Funds Fund-Basket Funds Participation Funds

Funds Funds Funds