Page 28 - Turkinsurance Digital Magazine

P. 28

26 pension outlook

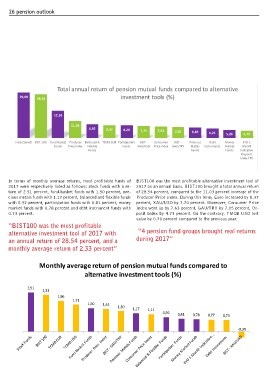

Total annual return of pension mutual funds compared to alternative

29,69 28,54 investment tools (%)

17,59

11,03

8,95 8,37 8,20 7,74 7,63 7,05 6,82 6,21 5,26 4,73

Hisse Senedi BIST 100 Fund Basket Producer Balanced & TCMB EUR Participation BIST - Consumer BIST - Precious Debt Money KYD 1

Funds Price Index Flexible Funds XAU/USD Price Index GAU/TRY Metals Instruments Market Month

Funds Funds Funds Indicative

Deposit

Index TRY

In terms of monthly average returns, most profitable funds of BIST100 was the most profitable alternative investment tool of

2017 were respectively listed as follows: stock funds with a re- 2017 on an annual basis. BIST100 brought a total annual return

turn of 2.51 percent, fund-basket funds with 1.50 percent, pre- of 28.54 percent, compared to the 11.03 percent increase of the

cious metals funds with 1.17 percent, balanced and flexible funds Producer Price Index. During this term, Euro increased by 8.37

with 0.92 percent, participation funds with 0.81 percent, money percent, XAU/USD by 7.74 percent. Moreover, Consumer Price

market funds with 0.78 percent and debt instrument funds with Index went up by 7.63 percent, GAU/TRY by 7.05 percent, De-

0.73 percent. posit Index by 4.73 percent. On the contrary, TMCB USD lost

value by 0.70 percent compared to the previous year.

“BIST100 was the most profitable

alternative investment tool of 2017 with “4 pension fund groups brought real returns

an annual return of 28.54 percent, and a during 2017”

monthly average return of 2.33 percent”

Monthly average return of pension mutual funds compared to

alternative investment tools (%)

2,51

2,33

1,96

1,71

1,50 1,44 1,30

1,17

1,11

0,92 0,81 0,78 0,77 0,73

-0,39