Page 27 - Turkinsurance Digital Magazine

P. 27

25

Highest growth of 2017 was in Stock Funds

Stock funds were the most profitable pension fund group in 2017, with an annual return

of 29.69 percent and a monthly return of 2.51 percent. Money market funds had the

highest outstanding rate with an annual average rate of 3.25 percent

Fund size of the Individual Pension System (BES) had reached at least 80 percent of their portfolio consisting of other mutu-

15 billion 72 million USD at the end of 2016, which increased al funds and stock exchange funds, ranked second by providing

by 4 billion 986 million USD at the end of 2017 up to 19 billion a return of 17.59 percent during 2017. Balanced and flexible

100 million USD. Total funds of participants grew by 35.33 per- funds whose portfolios are managed completely according to the

cent annually according to USD based results; stock funds being changing market circumstances provided a return of 8.95 per-

the most profitable pension funds based on annual and monthly cent in 2017, being the third most profitable fund group. Partic-

averages. On the other hand, BIST 100 was the alternative in- ipation funds, which are mostly preferred by investors wishing to

vestment tool that brought the highest return to its investors. invest in interest-free money and capital market tools, provided

Money mart funds had the highest outstanding rate in terms of a return of 8.20; followed by the 6.82 percent return brought by

annual averages. precious metals funds, which continuously invest more than half

of their portfolio in precious metals such as gold and other pre-

“Stock funds brought an average return of cious metals traded in national and international stock exchang-

2.51 percent on a monthly basis, while fund- es, and capital market tools based on such metals. During this

period, debt instruments that were mostly preferred by investors

basket funds brought 1.50 percent” with a balanced risk profile provided a return of 6.21 percent;

while money market funds brought 5.26 percent to their inves-

During 2017, stock funds were the most profitable among the tors with low-risk profile, having a portfolio consisting of money

pension funds aiming to bring long term returns to its investors. and capital market tools with high liquidity and maximum ma-

Continuously investing at least 51 percent of their fund portfolio turities of 184 days. Another striking result of the money market

in the shares of domestic partnerships and bearing high returns funds was the fact that they did not cause their investors to lose

as well as high risks, these funds brought 29.69 percent of return in any month of 2017.

during 2017. Fund-basket funds, which are high-risk funds with

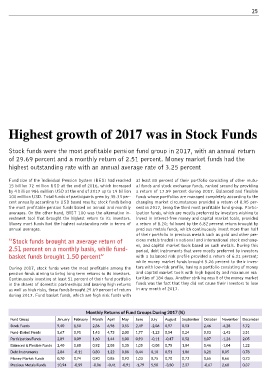

Monthly Returns of Fund Groups During 2017 (%)

Fund Group January February March April May June July August September October November December

Stock Funds 9,40 1,50 2,86 6,98 3,55 2,49 -2,06 0,97 0,53 2,46 -4,28 5,72

Fund-Basket Funds 5,67 0,91 1,43 4,73 2,00 1,77 -1,23 0,54 0,24 0,83 -2,43 3,51

Participation Funds 2,89 0,09 1,60 1,44 1,00 0,93 -0,11 -0,47 0,52 1,07 -1,26 2,05

Balanced & Flexible Funds 2,40 0,88 0,92 2,05 1,35 1,05 -0,08 0,75 1,04 0,46 -1,04 1,22

Debt Instruments 2,84 -0,11 0,80 1,22 0,88 0,44 0,10 0,51 1,06 0,21 0,05 0,78

Money Market Funds 0,70 0,74 0,90 0,85 0,93 1,03 0,75 0,70 0,73 0,65 0,66 0,73

Precious Metals Funds 10,94 -0,59 -0,06 -0,41 -0,91 -1,79 5,58 -3,50 2,37 -0,67 2,68 0,37