Page 27 - Turkinsurance Digital Magazine

P. 27

27

Premium production reached TRY 304

billion in the first quarter

In the first quarter of the year, total premium production exceeded TRY 304 billion, with

liability and health insurance being the top-producing branches. The highest growth in

premium production was recorded in the life insurance branch with a 74.67% increase.

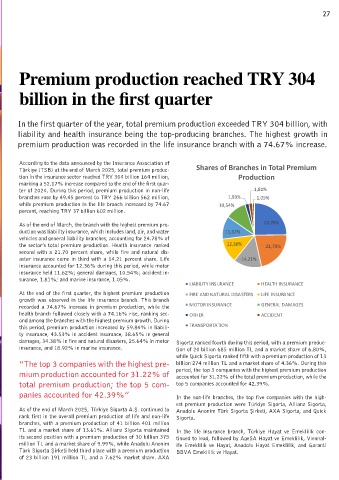

According to the data announced by the Insurance Association of Shares of Branches in Total Premium

Türkiye (TSB) at the end of March 2025, total premium produc-

tion in the insurance sector reached TRY 304 billion 164 million, Production

marking a 52.17% increase compared to the end of the first quar-

ter of 2024. During this period, premium production in non-life 1,81%

branches rose by 49.45 percent to TRY 266 billion 562 million, 1,93% 1,05%

while premium production in the life branch increased by 74.67 10,54%

percent, reaching TRY 37 billion 602 million.

24,78%

As of the end of March, the branch with the highest premium pro-

duction was liability insurance, which includes land, air, and water 11,62%

vehicles and general liability branches, accounting for 24.78% of

the sector’s total premium production. Health insurance ranked 12,36% 21,70%

second with a 21.70 percent share, while fire and natural dis-

aster insurance came in third with a 14.21 percent share. Life 14,21%

insurance accounted for 12.36% during this period, while motor

insurance held 11.62%; general damages, 10.54%; accident in-

surance, 1.81%; and marine insurance, 1.05%.

LIABILITY INSURANCE HEALTH INSURANCE

At the end of the first quarter, the highest premium production FIRE AND NATURAL DISASTERS LIFE INSURANCE

growth was observed in the life insurance branch. This branch

recorded a 74.67% increase in premium production, while the MOTOR INSURANCE GENERAL DAMAGES

health branch followed closely with a 74.16% rise, ranking sec- OTHER ACCIDENT

ond among the branches with the highest premium growth. During

this period, premium production increased by 59.84% in liabili- TRANSPORTATION

ty insurance, 43.53% in accident insurance, 38.65% in general

damages, 34.38% in fire and natural disasters, 25.64% in motor Sigorta ranked fourth during this period, with a premium produc-

insurance, and 18.92% in marine insurance. tion of 20 billion 685 million TL and a market share of 6.80%,

while Quick Sigorta ranked fifth with a premium production of 13

“The top 3 companies with the highest pre- billion 274 million TL and a market share of 4.36%. During this

mium production accounted for 31.22% of period, the top 3 companies with the highest premium production

accounted for 31.22% of the total premium production, while the

total premium production; the top 5 com- top 5 companies accounted for 42.39%.

panies accounted for 42.39%” In the non-life branches, the top five companies with the high-

est premium production were Türkiye Sigorta, Allianz Sigorta,

As of the end of March 2025, Türkiye Sigorta A.Ş. continued to Anadolu Anonim Türk Sigorta Şirketi, AXA Sigorta, and Quick

rank first in the overall premium production of life and non-life Sigorta.

branches, with a premium production of 41 billion 401 million

TL and a market share of 13.61%. Allianz Sigorta maintained In the life insurance branch, Türkiye Hayat ve Emeklilik con-

its second position with a premium production of 30 billion 375 tinued to lead, followed by AgeSA Hayat ve Emeklilik, Viennal-

million TL and a market share of 9.99%, while Anadolu Anonim ife Emeklilik ve Hayat, Anadolu Hayat Emeklilik, and Garanti

Türk Sigorta Şirketi held third place with a premium production BBVA Emeklilik ve Hayat.

of 23 billion 191 million TL and a 7.62% market share. AXA