Page 20 - Turkinsurance Digital Magazine

P. 20

20 insurance outlook

Earthquake has been forgotten,

insurance has slowed down

According to the data of the Natural Disaster Insurance Agency (DASK), the number of

compulsory earthquake insurance policies reached 11.5 million units as of March 2024.

Thus, the insurance rate increased to 57.50%. Although the DASK insurance rate is in-

creasing with each passing period, there is still a long way to go here.

In the statistics of DASK, which was established after the 1999 It is noteworthy that 46.9% of the total premium production

Gölcük Earthquake, which caused the destruction or damage of comes from the Marmara Region, which has 4 million 483 thou-

more than 100 thousand buildings in Turkey, in March 2024, sand 8 insured housing units. The Aegean Region, which houses 1

it was shared that there are a total of 20 million 32 thousand million 723 thousand 40 insured housing units, contributes 18%

houses in Turkey and the number of insured houses has reached to premium production, while the Mediterranean Region, with 1

11 million 508 thousand 562. million 361 thousand 39 insured housing units, contributes 6.8%

to premium production. The distribution rates of other regions in

The insurance rate in Turkey, which is faced with the risk of premium production are as follows: The Central Anatolia Region

earthquakes at any time, increased from 53 percent at the end of with 1 million 964 thousand 514 insured houses is 9.6 percent;

2019 to 56.6 percent as of November 2020. In 2022, compul- the Black Sea Region with 891 thousand 595 insured houses is

sory earthquake insurance reached the number of 8 million 797 6.8 percent; the South-Eastern Anatolia Region with 578 thou-

thousand 607 policies in October, while premium production was sand 666 houses is 3.2 percent and the Eastern Anatolia Region

seen as 1 billion 745 million 915 thousand 635 TL. In March with 506 thousand 700 insured houses is 6.4 percent.

2023, the total insurance rate was 57.1 percent, while the num-

ber of policies in force was 11.4 million. This figure was record-

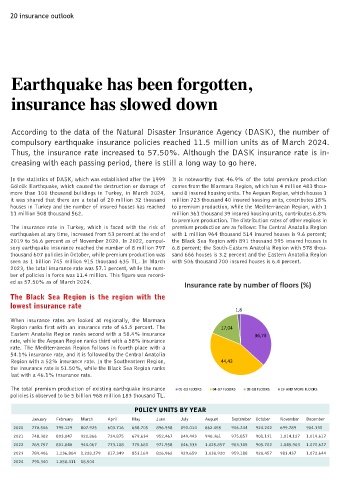

ed as 57.50% as of March 2024. Insurance rate by number of floors (%)

The Black Sea Region is the region with the

lowest insurance rate

1,8

When insurance rates are looked at regionally, the Marmara

Region ranks first with an insurance rate of 65.5 percent. The 17,04

Eastern Anatolia Region ranks second with a 58.4% insurance 36,73

rate, while the Aegean Region ranks third with a 58% insurance

rate. The Mediterranean Region follows in fourth place with a

54.1% insurance rate, and it is followed by the Central Anatolia

Region with a 52% insurance rate. In the Southeastern Region, 44,43

the insurance rate is 51.50%, while the Black Sea Region ranks

last with a 46.1% insurance rate.

The total premium production of existing earthquake insurance 01-03 FLOORS 04-07 FLOORS 08-18 FLOORS 19 AND MORE FLOORS

policies is observed to be 5 billion 968 million 183 thousand TL.

POLICY UNITS BY YEAR

January February March April May June July August September October November December

2020 770.506 795.129 807.925 603.716 658.705 896.958 890.014 862.455 906.244 924.242 699.789 904.330

2021 748.382 803.047 922.866 724.875 679.634 952.467 849.443 940.361 975.857 901.131 1.014.127 1.019.617

2022 769.757 801.840 944.067 773.108 775.680 971.958 846.333 1.025.857 983.305 905.702 1.045.903 1.070.627

2023 789.406 1.236.804 1.228.279 817.349 853.169 826.962 929.659 1.038.920 959.188 920.457 983.437 1.072.644

2024 791.340 1.058.411 18.504