Page 35 - Turkinsurance Digital Magazine

P. 35

33

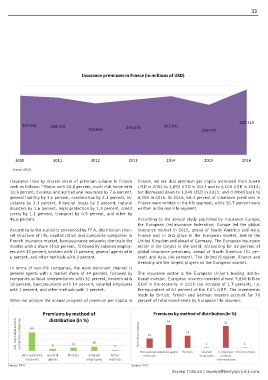

Insurance premiums in France (in millions of USD)

327.320

297.034 288.703 293.641

258.665 275.671 250.772

2010 2011 2012 2013 2014 2015 2016

Source: OECD

Source: C.I.A.

Insurance lines by market share of premium volume in France France, we see that premium per capita increased from 3,645

rank as follows: “Motor with 20.8 percent, multi risk home with USD in 2012 to 3,892 USD in 2013 and to 4,104 USD in 2014;

10.3 percent, business and agricultural insurance by 7.6 percent, but decreased down to 3,549 USD in 2015; and climbed back to

general liability by 3.6 percent, construction by 2.1 percent, as- 4,205 in 2016. In 2016, 64.3 percent of insurance premiums in

sistance by 2.1 percent, financial losses by 2 percent, natural France were written in the life segment; while 35.7 percent were

disasters by 1.6 percent, legal protection by 1.3 percent, credit written in the non-life segment.

surety by 1.1 percent, transport by 0.9 percent, and other by

46.6 percent. According to the annual study published by Insurance Europe,

the European (re)insurance federation; Europe led the global

According to the statistics announced by FFA, distribution chan- insurance market in 2015, ahead of North America and Asia.

nel structure of life, capitalization and composite companies in France was in 2nd place in the European market, behind the

French insurance market, bancassurance networks dominate the United Kingdom and ahead of Germany. The European insurance

market with a share of 65 percent; followed by salaried employ- sector is the largest in the world, accounting for 32 percent of

ees with 15 percent, brokers with 11 percent, general agents with global insurance premiums, ahead of North America (31 per-

6 percent, and other methods with 3 percent. cent) and Asia (30 percent). The United Kingdom, France and

Germany are the largest players on the European market.

In terms of non-life companies, the most dominant channel is

general agents with a market share of 34 percent, followed by The insurance sector is the European Union’s leading institu-

companies without intermediaries with 32 percent, brokers with tional investor. European insurers invested almost 9,800 billion

18 percent, bancassurance with 14 percent, salaried employees EUR in the economy in 2015 (an increase of 1.7 percent), i.e.

with 1 percent, and other methods with 1 percent. the equivalent of 61 percent of the EU’s GDP. The investments

made by British, French and German insurers account for 70

When we analyze the annual progress of premium per capita in percent of total investments by European life insurers.

Premiums by method of Premiums by method of distribution (in %)

distribution (in %)

Life, capitalisation and composite companies 65 11 15 Non-life companies 14 18 1 1

34

32

6

3

Salaried

Bancassurance General Brokers Salaried Other Bancassurance General agents Brokers employees Companies Other methods

without

networks

networks agents employees methods intermediaries

Source: FFA Source: FFA

Zeynep Tütüncü / zeynept@bestyayincilik.com