Page 33 - Turkinsurance Digital Magazine

P. 33

33

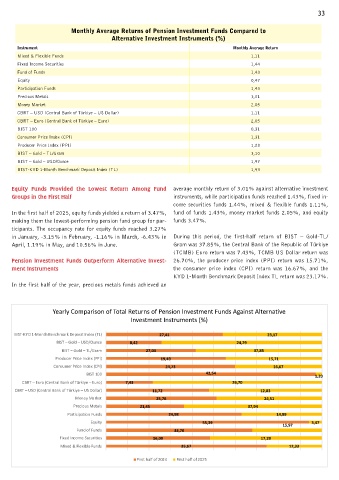

Monthly Average Returns of Pension Investment Funds Compared to

Alternative Investment Instruments (%)

Instrument Monthly Average Return

Mixed & Flexible Funds 1,11

Fixed Income Securities 1,44

Fund of Funds 1,43

Equity 0,47

Participation Funds 1,43

Precious Metals 3,01

Money Market 2,05

CBRT – USD (Central Bank of Türkiye – US Dollar) 1,11

CBRT – Euro (Central Bank of Türkiye – Euro) 2,05

BIST 100 0,31

Consumer Price Index (CPI) 1,31

Producer Price Index (PPI) 1,23

BIST – Gold – TL/Gram 3,10

BIST – Gold – USD/Ounce 1,97

BIST-KYD 1-Month Benchmark Deposit Index (TL) 1,93

Equity Funds Provided the Lowest Return Among Fund average monthly return of 3.01% against alternative investment

Groups in the First Half instruments, while participation funds reached 1.43%, fixed in-

come securities funds 1.44%, mixed & flexible funds 1.11%,

In the first half of 2025, equity funds yielded a return of 3.47%, fund of funds 1.43%, money market funds 2.05%, and equity

making them the lowest-performing pension fund group for par- funds 3.47%.

ticipants. The occupancy rate for equity funds reached 3.27%

in January, -3.15% in February, -1.16% in March, -6.43% in During this period, the first-half return of BIST – Gold-TL/

April, 1.19% in May, and 10.56% in June. Gram was 37.85%, the Central Bank of the Republic of Türkiye

(TCMB) Euro return was 7.43%, TCMB US Dollar return was

Pension Investment Funds Outperform Alternative Invest- 26.70%, the producer price index (PPI) return was 15.71%,

ment Instruments the consumer price index (CPI) return was 16.67%, and the

KYD 1-Month Benchmark Deposit Index TL return was 23.17%.

In the first half of the year, precious metals funds achieved an

Yearly Comparison of Total Returns of Pension Investment Funds Against Alternative

Investment Instruments (%)

BIST-KYD 1-Month Benchmark Deposit Index (TL) 27,41 23,17

BIST – Gold – USD/Ounce 8,42 24,29

BIST – Gold – TL/Gram 27,04 37,85

Producer Price Index (PPI) 19,49 15,71

Consumer Price Index (CPI) 24,73 16,67

BIST 100 42,54 1,20

CBRT – Euro (Central Bank of Türkiye – Euro) 7,43 26,70

CBRT – USD (Central Bank of Türkiye – US Dollar) 11,72 12,83

Money Market 25,76 24,51

Precious Metals 21,45 37,94

Participation Funds 24,98 14,89

Equity 55,39 15,97 3,47

Fund of Funds 33,70

Fixed Income Securities 16,09 17,29

Mixed & Flexible Funds 35,67 12,33

First half of 2024 First half of 2025