Page 33 - Turkinsurance Digital Magazine

P. 33

31

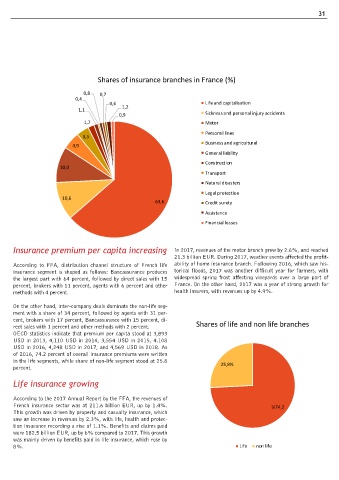

Shares of insurance branches in France (%)

0,8 0,7

0,4

0,6 Life and capitalisation

1,1 1,2

0,9 Sickness and personal injury accidents

1,7 Motor

Personal lines

3,5

Business and agricultural

4,9

General liability

Construction

10,0

Transport

Natural disasters

Legal protection

10,6

63,6 Credit surety

Assistance

Financial losses

Insurance premium per capita increasing In 2017, revenues of the motor branch grew by 2.6%, and reached

21.3 billion EUR. During 2017, weather events affected the profit-

According to FFA, distribution channel structure of French life ability of home insurance branch. Following 2016, which saw his-

insurance segment is shaped as follows: Bancassurance produces torical floods, 2017 was another difficult year for farmers, with

the largest part with 64 percent, followed by direct sales with 15 widespread spring frost affecting vineyards over a large part of

percent, brokers with 11 percent, agents with 6 percent and other France. On the other hand, 2017 was a year of strong growth for

methods with 4 percent. health insurers, with revenues up by 4.9%.

On the other hand, inter-company deals dominate the non-life seg-

ment with a share of 34 percent, followed by agents with 31 per-

cent, brokers with 17 percent, Bancassurance with 15 percent, di-

rect sales with 1 percent and other methods with 2 percent. Shares of life and non life branches

OECD statistics indicate that premium per capita stood at 3,893

USD in 2013, 4,110 USD in 2014, 3,554 USD in 2015, 4.108

USD in 2016, 4,248 USD in 2017, and 4,569 USD in 2018. As

of 2016, 74.2 percent of overall insurance premiums were written

in the life segments, while share of non-life segment stood at 25.8 25,8%

percent.

Life insurance growing

According to the 2017 Annual Report by the FFA, the revenues of

French insurance sector was at 211.6 billion EUR, up by 1.4%. %74,2

This growth was driven by property and casualty insurance, which

saw an increase in revenues by 2.3%, with life, health and protec-

tion insurance recording a rise of 1.1%. Benefits and claims paid

were 182.5 billion EUR, up by 6% compared to 2017. This growth

was mainly driven by benefits paid in life insurance, which rose by

8%. Life non life