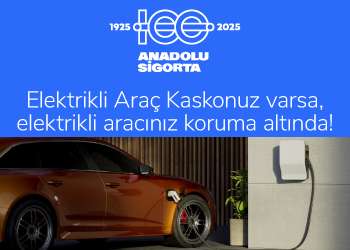

Coverage Limits to Be Applied in Traffic Insurance in 2026 Have Been Determined

In order to ensure that the damages incurred by entitled parties can be compensated in line with current economic conditions, the coverage limits applied in compulsory motor third-party liability insurance (traffic insurance) have been increased.

Accordingly, the coverage limit determined for property damage has been raised from TRY 300,000 to TRY 400,000, while the coverage limit stipulated for bodily injury has been increased from TRY 2.7 million to TRY 3.6 million. The newly determined coverage limits will be applied to all insurance contracts currently in force without any additional premium being charged.

On the other hand, the tariff application determined according to the type of use for certain vehicle groups has been rearranged. In determining the premiums of policies to be issued in the name of a real person operator, the private use type will be taken as the basis for up to five vehicles (including five) within the same vehicle group, while the corporate use type will apply for vehicles exceeding five units.

Respectfully announced to the public.

.gif)