Page 21 - Turkinsurance Digital Magazine

P. 21

21

In the first half of the year, the total

premium production in the insurance

sector amounted to 8.301 billion USD

In the first half of the year, the total premium production in the insurance sector in-

creased by 52.61% compared to the same period of the previous year, reaching 8.301

billion USD. During this period, liability and vehicle insurance played a prominent role in

premium production, with the most significant increase in premium production observed

in the accident and health insurance branches

According to the data announced by the Insurance Association of 114 thousand USD and a market share of 8.67%. In this period,

Turkey (T.S.B.) at the end of June 2023, the total premium pro- AXA Sigorta ranked fourth with 507 million 978 thousand USD

duction in the insurance sector increased by 52.61% compared to premium production and 6.12% market share, while HDI Sigorta

the second quarter of 2022 and reached 8 billion 301 million USD. ranked fifth with 491 million 356 thousand USD premium pro-

During this period, the premium production in non-life branches duction and 5.92% market share. In this period, the top 5 com-

increased by 57.73% to USD 7 billion 328 million, while the panies with the highest premiums in non-life branches are Türkiye

premium production in the life branch increased by 22.60% to Sigorta, Allianz Sigorta, Anadolu Anonim Türk Sigorta Şirketi,

USD 972 million. The increase in premium production, in Turkish Axa Sigorta and HDI Sigorta. In the life insurance branch, the

Lira terms, was 139.04% in non-life branches and 85.8% in life ranking of the top 5 companies remained unchanged from the first

branches, resulting in a total increase of 131.28%. The reason for quarter. Türkiye Hayat ve Emeklilik, AgeSA Hayat ve Emeklilik,

the lower increase in USD terms was the exchange rate difference. Anadolu Hayat Emeklilik, Viennalife Emeklilik ve Hayat, Allianz

(USD/TRY on 30.06.2023= 25.334; 30.06.2022= 16.7165) Yaşam ve Emeklilik constituted the top 5 companies in the life

insurance branch.

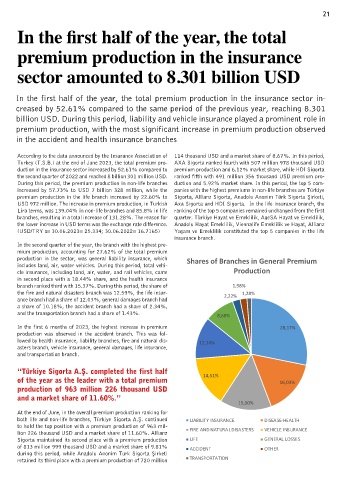

In the second quarter of the year, the branch with the highest pre-

mium production, accounting for 27.62% of the total premium

production in the sector, was general liability insurance, which Shares of Branches in General Premium

includes land, air, water vehicles. During this period, total vehi-

cle insurance, including land, air, water, and rail vehicles, came Production

in second place with a 18.44% share, and the health insurance

branch ranked third with 15.37%. During this period, the share of 1,98%

the fire and natural disasters branch was 12.59%, the life insur- 2,22% 1,28%

ance branch had a share of 12.03%, general damages branch had

a share of 10.18%, the accident branch had a share of 2.34%,

and the transportation branch had a share of 1.43%. 8,68%

In the first 6 months of 2023, the highest increase in premium 28,17%

production was observed in the accident branch. This was fol-

lowed by health insurance, liability branches, fire and natural dis- 12,14%

asters branch, vehicle insurance, general damages, life insurance,

and transportation branch.

“Türkiye Sigorta A.Ş. completed the first half 14,51%

of the year as the leader with a total premium 16,03%

production of 963 million 226 thousand USD

and a market share of 11.60%.”

15,00%

At the end of June, in the overall premium production ranking for

both life and non-life branches, Türkiye Sigorta A.Ş. continued LIABILITY INSURANCE DISEASE-HEALTH

to hold the top position with a premium production of 963 mil- FIRE AND NATURAL DISASTERS VEHICLE INSURANCE

lion 226 thousand USD and a market share of 11.60%. Allianz

Sigorta maintained its second place with a premium production LIFE GENERAL LOSSES

of 813 million 999 thousand USD and a market share of 9.81% ACCIDENT OTHER

during this period, while Anadolu Anonim Türk Sigorta Şirketi

retained its third place with a premium production of 720 million TRANSPORTATION